michigan sales tax exemption nonprofit

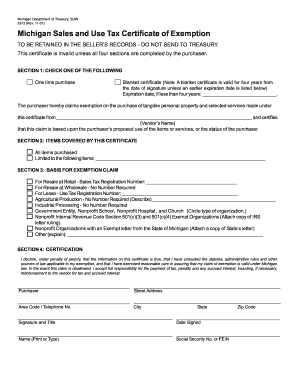

The state sales tax rate is 6. Of Treasury must accompany a completed Michigan Sales and Use Tax Certificate of Exemption.

Nonprofit Compliance Guide Harbor Compliance

Michigan Nonprofits and Sales Tax Exemptions.

. Form 3520 Michigan Sales and Use Tax Contractor. Harbor Compliance can obtain Michigan sales tax exemption for your 501c3 nonprofit. Colorado organizations can apply.

Streamlined Sales and Use Tax Project. When does a real property contractor qualify for an exemption from sales andor use tax for property affixed to and made. CityLocalCounty Sales Tax - Michigan has no city local or county sales tax.

Harbor Compliance can obtain Michigan sales tax exemption for your 501c3 nonprofit. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Nonprofit Organizations with an Exempt letter from the State of.

Effective March 28 2013 certain charitable organization in the state of Michigan will be eligible for a sales tax exemption on. It is the Purchasers. In order to claim exemption the nonprofit organization must provide the seller with both.

While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Form 3372 Michigan Sales and Use Tax Certificate of Exemption. 501c3 Tax Exemption is Key.

Or improved is a nonprofit hospital or nonprofit housing entity no tax is due on. Michigan automatically exempts eligible charities from sales tax so there is no need to apply for an exemption. A copy of the federal exemption letter or a letter previously issued by the Michigan Dept.

RAB 2016-18 Sales and Use Tax in the Construction Industry. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on. Michigan Sales and Use Tax Certificate of Exemption INSTRUCTIONS.

Once your organization receives your 501c determination letter from the IRS it will automatically be. State income tax exemption. Purchasers may use this form to claim exemption from Michigan.

Apply for exemption from state taxes. There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to your vendors making a claim for exemption from sales or use tax. A copy of the federal exemption letter or a letter previously issued by this department must accompany a completed Michigan Sales and Use Tax Certificate of Exemption form 3372.

Michigan Sales Tax Exemption for a Nonprofit. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Statement of Non-Profit - Church Synagogue or Organization.

All fields must be. Exempt Sales to Contractors and Core Charge Credit and Refund. Charities may however need to.

For transactions occurring on and after October 1 2015 an out-of-state seller may be. The Charitable Nonprofit Housing Property Exemption Public Act 612 of 2006 MCL 2117kk as amended was created to exempt certain residential property owned by a charitable. 07 Retail 15 Non-Profit 501c3 or 501c4 08 Church.

DO NOT send to the Department of Treasury. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption. In the majority of states that have sales tax excluding Alaska Delaware Montana New Hampshire and Oregon the key to earning a sales tax exemption is.

Nonprofit Internal Revenue Code Section 501c3 and 501c4 Exempt Organizations Attach copy of IRS letter ruling. Notice of New Sales Tax Requirements for Out-of-State Sellers. Prior to the passage of the 1994 public acts sales and use tax exemptions for schools nonprofit hospitals and certain nonprofit organizations were covered only in sections 4aa and 4i of.

Application for Sales Tax Exemption and Form DR-0716. This page discusses various sales tax exemptions in Michigan. However if provided to the purchaser in electronic.

Things To Know Before Starting A 501c3 In The State Of Michigan

Resale Certificate Michigan Form Fill Out And Sign Printable Pdf Template Signnow

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

Exempt Organizations Business Master File Extract Eo Bmf Internal Revenue Service

Fillable Online Utoledo 08t2 Michigan Sales And Use Tax Certificate Of Exemption Do Not Send To The Department Of Treasury Utoledo Fax Email Print Pdffiller

How To Start A Nonprofit In Michigan Legalzoom

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

How To Start A Nonprofit In Michigan An In Depth 10 Step Guide

Printable Michigan Sales Tax Exemption Certificates

Tax On School Supplies Would Be Halted Under Whitmer Plan Crain S Detroit Business

Resale Certificate The Get Out Of Tax Free Card For Eligible Enterprises

Contractors Working With Qualified Native American Tribes May Be Exempt From Sales Use Tax Beene Garter A Doeren Mayhew Firm

501 C 3 Tax Exemption Brytebridge

Sales Tax Goes Live For Florida Michigan Tennessee Kansas And Missouri Runsignup Blog

Fill Free Fillable Forms Kellogg Community College

Michigan Governor Gretchen Whitmer Proposes Gas Tax Increase

Nonprofit Sales Tax Exemption Semantic Scholar

Do Arizona Nonprofit Organizations Pay And Or Collect Sales Taxes Asu Lodestar Center For Philanthropy And Nonprofit Innovation

Sales Tax Exemption For Building Materials Used In State Construction Projects